- 14th August 2023

- Posted by: Alpha Asset Finance

- Categories: Alpha News, Asset Finance, Business Finance, Industry News

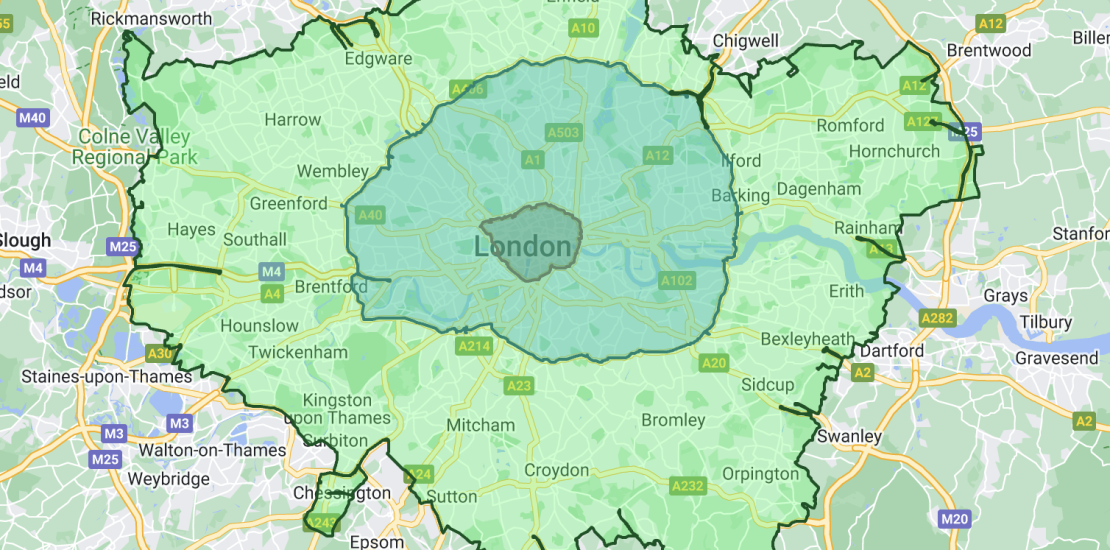

On 29th August, a significant expansion of the Ultra Low Emission Zone (ULEZ) will take effect in London. This expansion will have far-reaching implications for all businesses operating within and around the capital. SMEs, in particular, will face a crucial decision: either update their fleets to comply with the stricter emissions standards or face hefty fines for non-compliance.

Moreover, this expansion will eventually reach cities like Manchester, Birmingham, and Leeds. As SMEs brace for these changes, Alpha Asset Finance emerges as a strategic ally, helping businesses prepare for the ULEZ expansion by offering flexible financing options. In this blog, we will explore how Alpha Asset Finance can assist businesses in upgrading their fleets and releasing equity to cover increasing charges.

Fleet Financing Solutions

Understanding the financial burden that updating an entire fleet can impose on SMEs, Alpha Asset Finance provides tailored fleet financing solutions. Whether businesses need to lease new low-emission vehicles or opt for hire purchase agreements, Alpha Asset Finance offers flexible terms that align with each company’s unique cash flow situation. This enables SMEs to upgrade their fleets efficiently and cost-effectively without a massive upfront capital outlay.

Transition to Low-Emission Vehicles

As businesses strive to reduce their carbon footprint and comply with the ULEZ expansion, transitioning to low-emission vehicles becomes imperative. Alpha Asset Finance collaborates with a wide network of suppliers and manufacturers, ensuring access to a diverse range of eco-friendly vehicles. From electric cars to hybrid vans, SMEs can choose from environmentally conscious options that align with their operational needs and budgetary constraints.

Releasing Equity through Asset Refinancing

Alpha Asset Finance provides an innovative solution: asset refinancing for SMEs facing cash flow constraints due to the ULEZ expansion. Through this process, businesses can release equity in existing assets such as vehicles, machinery, or equipment. The released funds can then be used to finance fleet upgrades or cover the increasing ULEZ charges. This approach not only eases the financial burden but also optimises cash flow to support other essential business operations.

Expert Consultation and Support

Navigating the complexities of the ULEZ expansion and fleet upgrades can be challenging for SMEs. Alpha Asset Finance offers expert consultation and support to seamlessly guide businesses through the process. Their team of professionals understands the unique needs and challenges SMEs face in different industries, enabling them to provide personalised solutions and advice. From selecting the most suitable financing option to handling paperwork and negotiations, Alpha Asset Finance ensures a smooth and efficient experience.

Future-Proofing Your Business

Beyond immediate compliance with the ULEZ expansion, investing in low-emission vehicles and eco-friendly assets can future-proof your business. As environmental regulations and consumer preferences continue to evolve, companies with sustainable practices will gain a competitive edge. Alpha Asset Finance empowers SMEs to take proactive steps toward sustainability, enhancing their brand image and opening up new business opportunities.

The upcoming expansion of the ULEZ presents a significant challenge for SMEs operating in and around London, with similar changes expected in other major cities. Alpha Asset Finance emerges as a reliable partner, offering solutions to help businesses prepare for this transition.

Alpha Asset Finance assists SMEs in complying with environmental regulations while optimising their cash flow through fleet financing options, transitioning to low-emission vehicles, asset refinancing, and expert consultation.

By partnering with Alpha Asset Finance, SMEs can navigate the changing landscape confidently, ensuring long-term sustainability and growth in the face of environmental challenges.